how are property taxes calculated in lee county florida

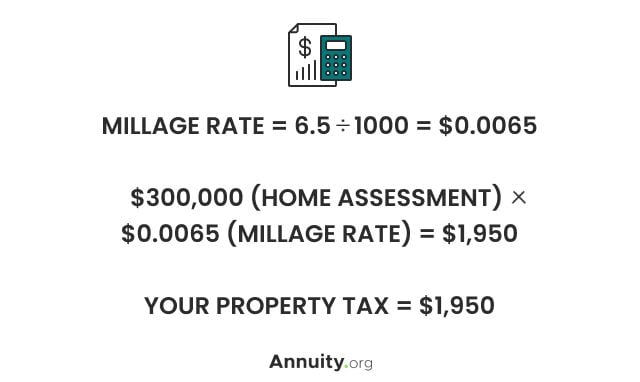

When you are asked to rate them millages appear. A reassessed market value is then multiplied times a total rate from all taxing entities together to determine tax bills.

The Cost Of Buying And Owning A Property

Lee County collects on average 104 of a propertys assessed fair market value as property tax.

. The actual amount of the taxes is 477965. For additional information please refer to the tourist development tax FAQs or call the Tourist Development Tax Unit of the Inspector General Department at 239-533-2190. The Lee County Sales Tax is collected by the merchant on all qualifying sales made within Lee County.

The remaining 20000 of your propertys value is taxable because its less than the 50000 minimum to be eligible for the additional homestead exemption. An assessor from the countys office establishes your propertys market value. See Results in Minutes.

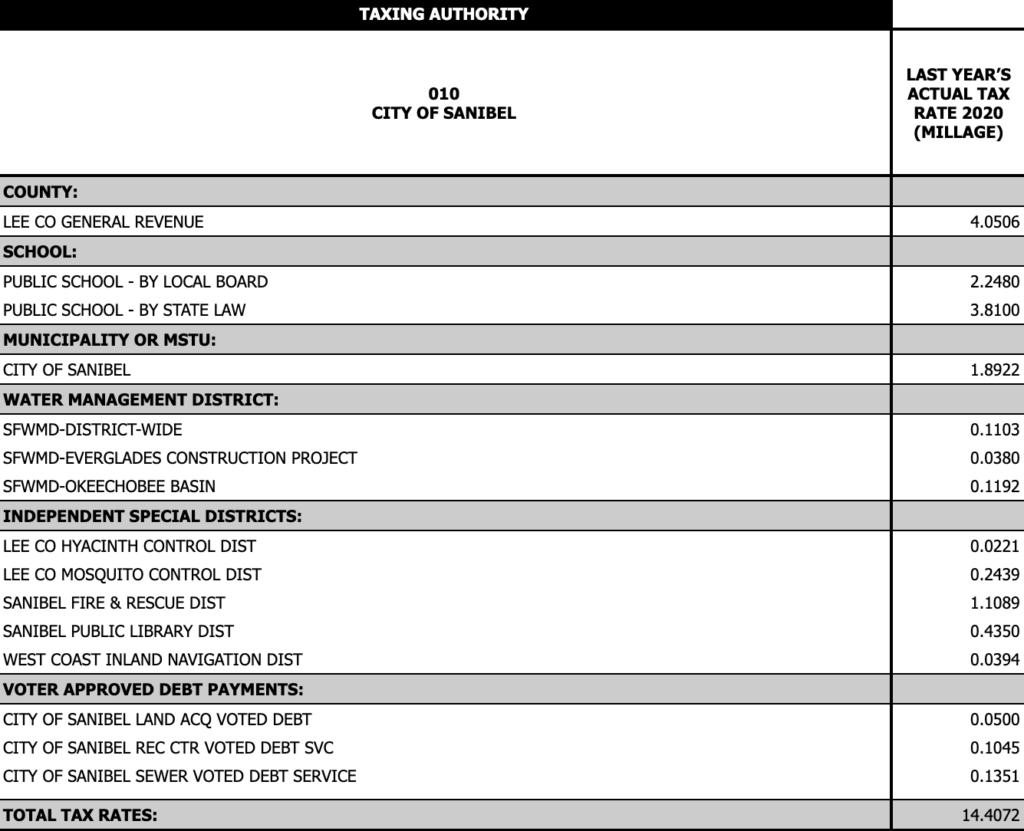

Each of Lee Countys district boards determines a budget for public services and community improvement projects and levies property taxes to fit this budget. While many other states allow counties and other localities to collect a local option sales tax Florida does not permit local sales taxes to be collected. Ad valorem taxes are based on the value of property.

In Jackson County Missouri residents pay an average effective property tax rate of 135. Lee County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. When it comes to real estate property taxes are almost always based on the value of the land.

Property values are usually determined by a local or county assessor. Then subtract that amount from the market value to arrive at the assessed value. Our Lee County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States.

The more valuable the land the higher the property taxes. The next 25000 of assessed value is taxable but the remaining 15000 is eligible for exemption. 104 of home value Yearly median tax in Lee County The median property tax in Lee County Florida is 2197 per year for a home worth the median value of 210600.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. 260000 Assessed Value - 25000 Exemption 235000 Taxable Value X 0007 Millage 1645 School Taxes 260000 Assessed Value - 50000 Exemption 210000 Taxable Value X 0011 Millage 2310 Non-school Taxes 1645 School Taxes 2310 Non-school Taxes 3955 Total Taxes Category. The median property tax also known as real estate tax in Lee County is 219700 per year based on a median home value of 21060000 and a median effective property tax rate of 104 of property value.

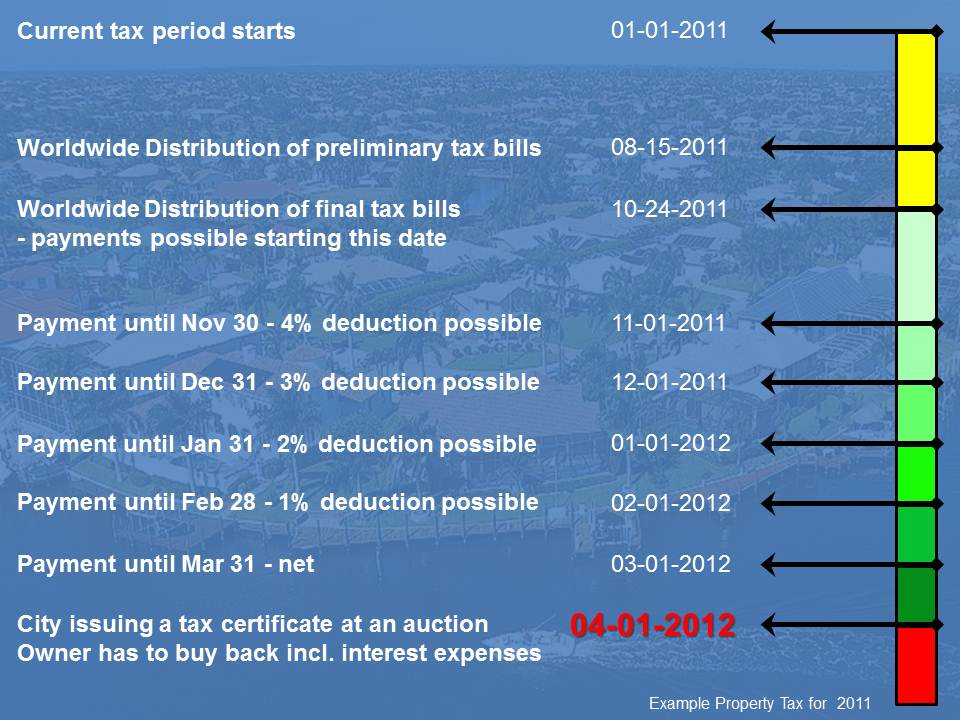

The taxes are assessed on a calendar year from Jan through Dec 365 days. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Cleaning fees or electricity charges a reasonable cap withheld from Security Deposit.

That amount is multiplied by the established tax levy which is the total of all applicable governmental taxing-empowered units levies. Ad Property Taxes Info. An appraiser from the countys office estimates your propertys worth.

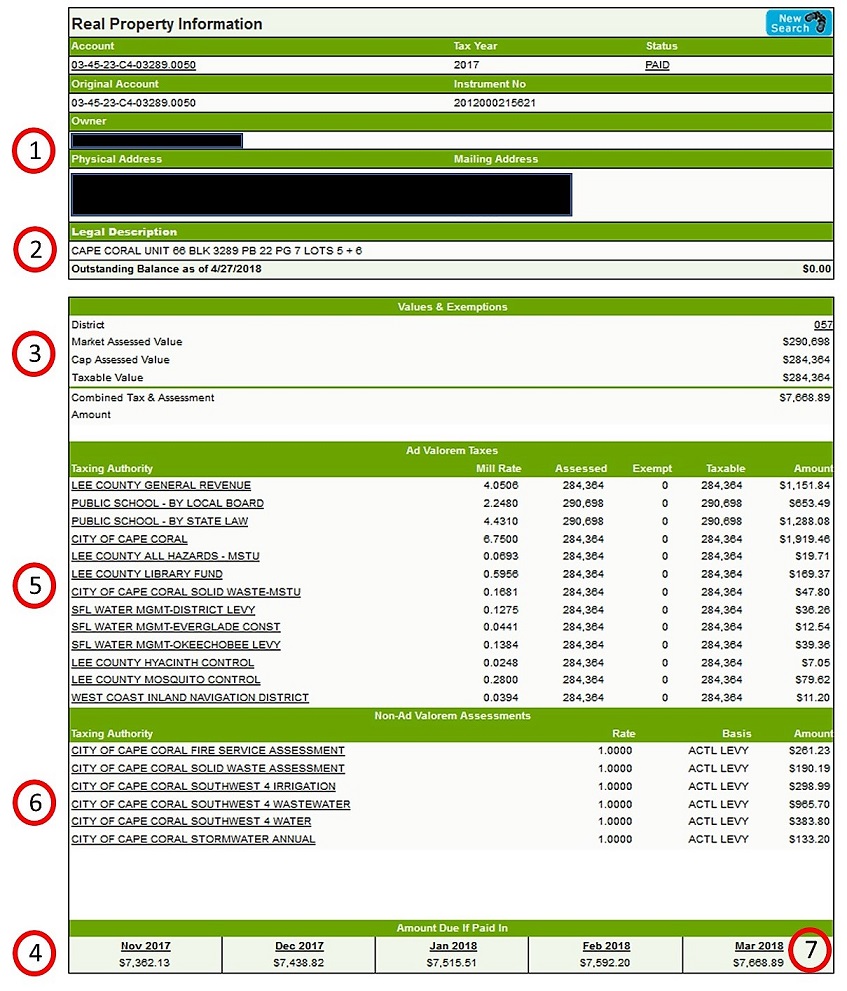

For example if the old homes Save Our Homes difference is 40 of its market value the new homes difference can be determined by multiplying 40 times the new homes market value. Lets look at the 2015 Ad Valorem taxes in detail. Lee County property taxes apply to each of the countys taxing districts and are calculated based on the value of your home and the cost of specific public services.

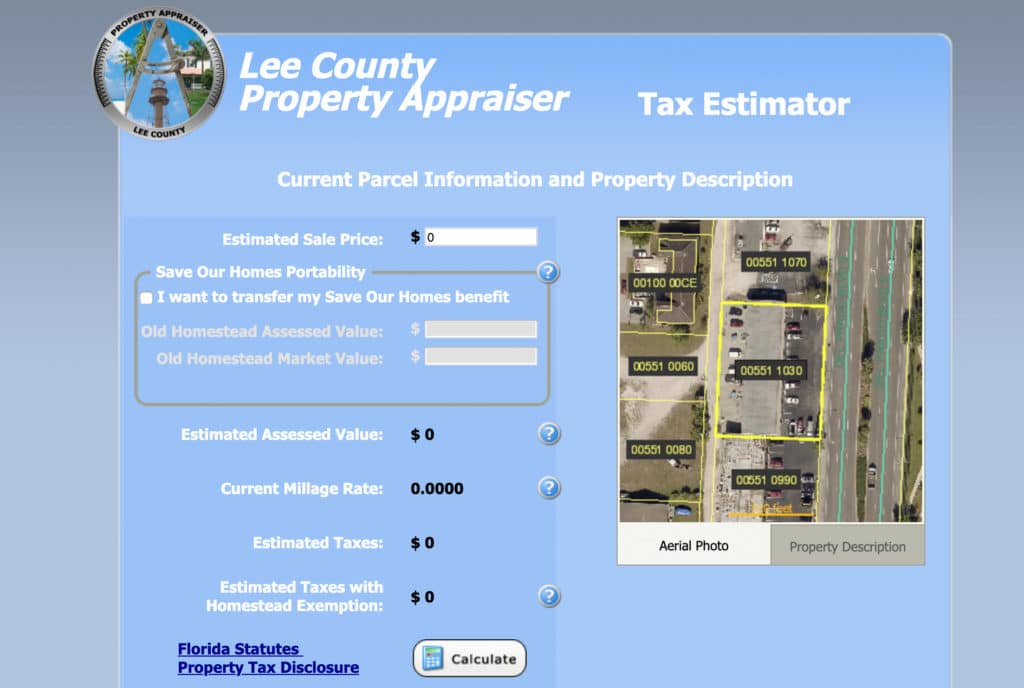

This is an estimate of what a property taxpayer who is not eligible for any exemptions may have to pay in taxes based on how the propertys assessed value is divided by the millage rates. Non-ad valorem assessments are fees for specific services such as solid waste disposal water management sewer storm water and special improvements. Peace of Mind Damage Insurance Policies.

The tax estimator assumes 90 of the sales price to be the assessed value for estimating property taxes. Taxation of real property must. Example Maximum deduction from market value.

Enter Any Address Receive a Comprehensive Property Report. Within those limits the. Find the assessed value of the property being taxed.

How are property taxes calculated in Lee County Florida. How Are Property Taxes Calculated In Lee County. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day.

If your propertys assessed value is 65000 youre eligible for a 25000 tax exemption. To calculate the property tax use the following steps. The Lee County Florida sales tax is 600 the same as the Florida state sales tax.

The taxes due on a property are calculated by multiplying the. Lee County Florida Property Tax Go To Different County 219700 Avg. Lee county collects very high property taxes and is among the top 25 of counties in the united states ranked by property tax collections.

Lee County Property Tax Getjerry Com

Florida Property Taxes Explained

South Carolina Property Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy

Recently Sold Homes In Lee County Fl 149 112 Transactions Zillow

Lee County Property Tax Getjerry Com

Florida Property Taxes Explained

The Cost Of Buying And Owning A Property

Property Taxes Calculating State Differences How To Pay

Florida Property Taxes Explained

Florida Property Taxes Explained

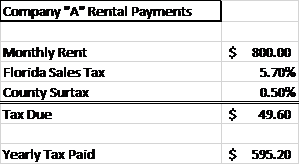

How To Calculate Fl Sales Tax On Rent

Lee County Fl Property Tax Search And Records Propertyshark

Florida Property Tax H R Block

Tax Estimator Lee County Property Appraiser

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One